How to Calculate Diluted Earnings Per Share using the If Converted Method

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 25

Lesson

Comments

Related Courses in Business

Course Description

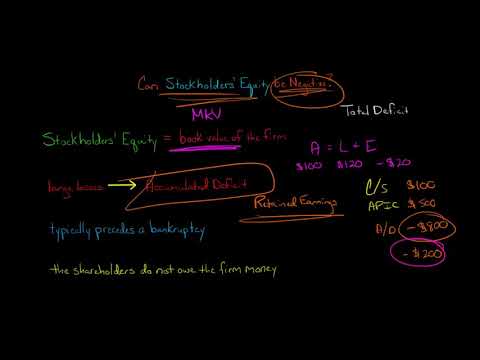

How do you calculate shareholders equity?

Stockholders' equity can be calculated by subtracting the total liabilities of a business from total assets or as the sum of share capital and retained earnings minus treasury shares.What are some examples of stockholders equity?

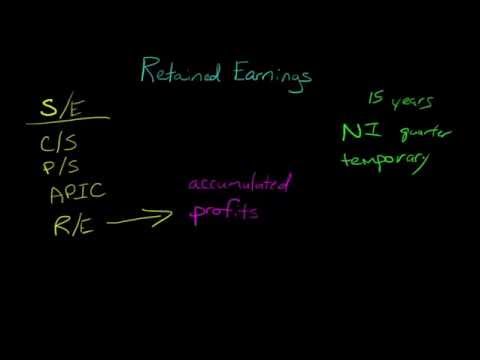

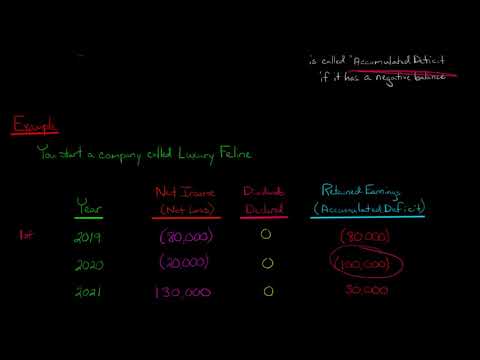

The most common stockholders' equity accounts are as follows:

Common stock. ...

Additional paid-in capital on common stock. ...

Preferred stock. ...

Additional paid-in capital on preferred stock. ...

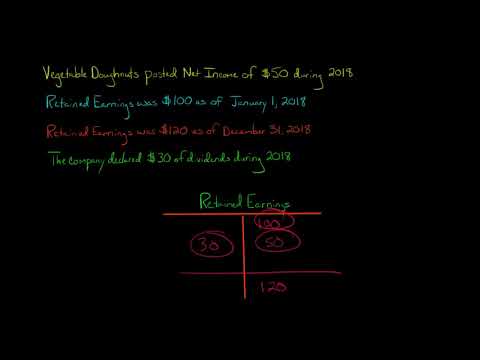

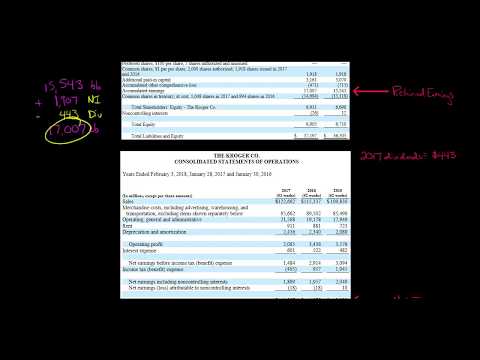

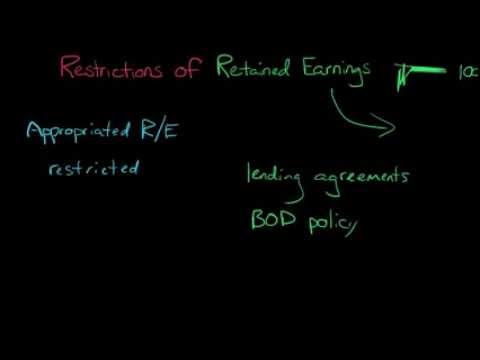

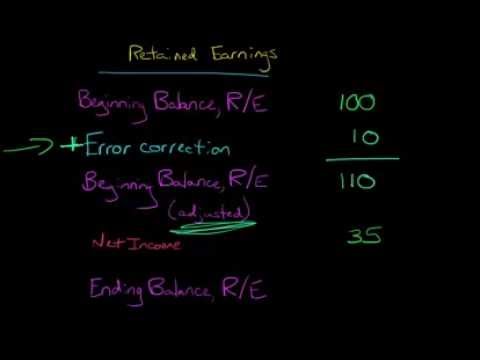

Retained earnings. ...

Treasury stock.What is stockholder equity made up of?

Four components that are included in the shareholders' equity calculation are outstanding shares, additional paid-in capital, retained earnings, and treasury stock. If shareholders' equity is positive, a company has enough assets to pay its liabilities; if it's negative, a company's liabilities surpass its assets.

Trends

Calendar design in Photoshop for beginners

Multiplying Fractions in Algebra

Digital Electronics

ADHD

YouTube channel growth strategies

Tree Drawing Fundamentals

Nikon tutorials and tips

Node JS with Mongoose ODM

House Planning with garden design basics

Logo Design

Data types used in MySQL database

Making money with article writing

Caulifl ower mashed potatoes recipe healthy

Earning money From Fiverr for beginners

Bitcoin Cryptocurrency Knowledge

Cinema 4D animated mograph for beginners

optical illusion drawing

Technical Analysis for Beginners

Creating 3D text in illustrator for beginners

Learning English Speaking

Recent

Illustrator business card design for beginners

Calendar design in Photoshop for beginners

Creating Google Ads account for beginners

Installing wordPress step by step

Converting PDF files to excel format

Uploading files in google drive 2023

Updating drivers on windows 11 for beginners

Changing mouse sensitivity in windows 10 or Laptop

Installing VLC media player in windows 10

Split Screen on macBook for beginners

Saving Locations in google maps for beginners

The complete Android Application Development Course in Hindi

WordPress Complete Course in Hindi

Swift Programming For IOS From Scratch Swift Programming Tutorial For Beginners

R Programming from Scratch

Adding shortcuts in google chrome for beginners

Data Structure using C from Scratch Data Structure Full Course C 2024

Creating aYouTube channel for beginners

PC performance optimization techniques

DATEDIF function in excel for beginners