Absorption Costing vs Variable Costing

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 8

Lesson

Comments

Related Courses in Business

Course Description

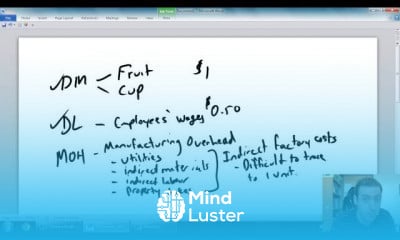

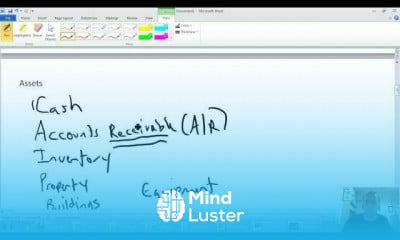

Variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the product-cost of production. ... It not only includes the cost of materials and labor, but also both, in which the fixed manufacturing overhead is allocated to products produced.What is the difference between absorption and variable costing?

Absorption costing, also known as full costing, entails allocating fixed overhead costs across all units produced for the period, resulting in a per-unit cost. Variable costing includes all of the variable direct costs in COGS but excludes direct, fixed overhead costs.What's included in variable costing?

Understanding a Variable Cost

The total expenses incurred by any business consist of variable and fixed costs. ...

Examples of variable costs are sales commissions, direct labor costs, cost of raw materials used in production, and utility costs.What are examples of a variable expense?

By definition, a variable expense is a cost that changes depending on your production level.

...

Examples of variable costs

Packaging costs.

Utilities, like electricity and water.

Credit card and bank fees.

Hourly wages and direct labor.

Shipping costs.

Raw materials.

Sales commissions.

Trends

Speak english fluently with confidence

MS Excel

Building a chatbot with Python

Learning English Speaking

Python programming fundamentals A Z

Generative AI tools for 2024

Creating YouTube videos for beginners

Content marketing for beginners

Python programming language

Excel Course Basic to Advanced

Center of Mass in Physics

Marketing basics for beginners

Phrasal Verbs in daily conversations

Web Development Tools Essentials

AI tools for business for beginners

Data Science with Python for beginners

Coding tools for developers

Google analytics 4 for beginners

Tools and toolbar in Photoshop for beginners

WordPress Complete Course in Hindi

Recent

Arabic numbers for beginners

Rating arabic handwriting techniques

Form verbal sentences in arabic

Arabic sentence structure for beginners

Phrasal Verbs in daily conversations

Speak english fluently with confidence

Rules for plural forms of irregular nouns

English slang dictionary for fluency

English idioms for everyday conversations

Native english vocabulary for fluency

Teach reading with Phonics for beginners

English speaking confidence techniques

Business english communication skills

American english conversation for beginners

Advanced english listening and vocabulary

English prepositions for beginners

Improve english Pronunciation for beginners

PGP in data science and engineering

Building a chatbot with Python

Python programming fundamentals A Z