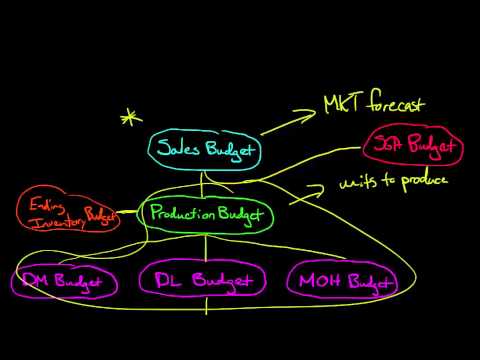

The Master Budget

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 17

Lesson

Comments

Related Courses in Business

Course Description

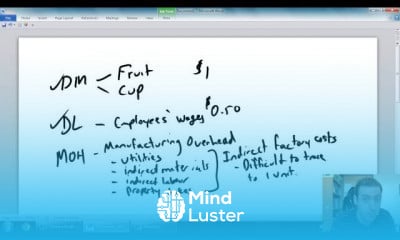

Budgeting is a process of looking at a business' estimated incomes (the money that comes into the business from selling products and services) and expenditures (the money that goes out form paying expenses and bills) over a specific period in the future.What are the 3 types of budgets?

Depending on these estimates, budgets are classified into three categories-balanced budget, surplus budget and deficit budget.What is budgeting and why is it important?

Budgeting creates a spending plan for your money and can help ensure there is always enough money to pay for food, bills, and other expenses. Having a budget is a good tool to avoid credit card debt and promotes saving. ... When we plan for emergencies, they do not become financially devastating.What is the meaning of budget and budgeting?

Budgeting is the process of creating a plan to spend your money. This spending plan is called a budget. Creating this spending plan allows you to determine in advance whether you will have enough money to do the things you need to do or would like to do. Budgeting is simply balancing your expenses with your income.What is the 50 20 30 budget rule?

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Trends

Cybersecurity fundamentals A Z

Graphic design tools for beginners

Web design basics

Web Design for Beginners

Accounting Finance course

E Commerce web design

UX UI design career

Customizing type for logos

Essential skills for web designers

UX design fundamentals

Figma web design

Create Animals icon in figma

Create food and drink icon in figma

Create a YouTube account on Your phone

Best zoology books

Figma mobile UI design essentials

Figma mobile app design

Web Design 101 Free Full Course

SQL for accountants and finance managers

Abstract Poster design in figma

Recent

Poultry vaccination

Rhode grass farming

Ice cream production techniques

Chili sauce production

Soil health and testing

Animal welfare

Housing requirements and feeding for poultry

Sources of chicks

Fish farming

Poultry house construction

Bee presence in watermelon flowering

French beans farming

Feeding stages for broilers

Dairy Production and dairy Cow farming

Bioinformatics basics

Bioinformatics databases

Vitamin A to Z tablets

Best zoology books

Best cream for piles pain

Laser surgery for piles