How to Calculate the Lease Liability | Lessee | IFRS 16

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 25

Lesson

Comments

Related Courses in Business

Course Description

IFRS 16 is an International Financial Reporting Standard promulgated by the International Accounting Standards Board providing guidance on accounting for leases. IFRS 16 was issued in January 2016 and is effective for most companies that report under IFRS since 1 January 2019.

IFRS 16 defines a lease term as the noncancellable period for which the lessee has the right to use an underlying asset including optional periods when an entity is reasonably certain to exercise an option to extend (or not to terminate) a lease.

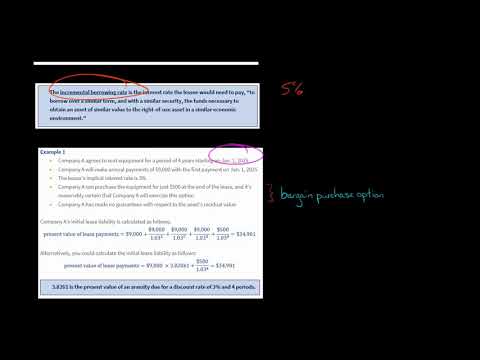

IFRS 16 requires that the 'right of use asset' and the lease liability should initially be measured at the present value of the minimum lease payments. The discount rate used to determine present value should be the rate of interest implicit in the lease.

Trends

Learning English Speaking

Speak english fluently with confidence

MS Excel

Building a chatbot with Python

Generative AI tools for 2024

Python programming fundamentals A Z

Content marketing for beginners

Creating YouTube videos for beginners

Python programming language

Python machine learning for beginners

Marketing basics for beginners

Cybersecurity fundamentals A Z

Makeup and Beauty

Phrasal Verbs in daily conversations

Tools and toolbar in Photoshop for beginners

Design Thinking

Introduction To Cyber Security

Excel Power Query in excel for beginners

PGP in data science and engineering

Python Programming | Edureka

Recent

Arabic numbers for beginners

Rating arabic handwriting techniques

Form verbal sentences in arabic

Arabic sentence structure for beginners

Phrasal Verbs in daily conversations

Speak english fluently with confidence

Rules for plural forms of irregular nouns

English slang dictionary for fluency

English idioms for everyday conversations

Native english vocabulary for fluency

Teach reading with Phonics for beginners

English speaking confidence techniques

Business english communication skills

American english conversation for beginners

Advanced english listening and vocabulary

English prepositions for beginners

Improve english Pronunciation for beginners

PGP in data science and engineering

Building a chatbot with Python

Python programming fundamentals A Z