Stock Futures Examples | Financial Derivatives Instrument for Risk Management | SFM |

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 4

Lesson

Comments

Related Courses in Business

Course Description

What are the types of financial derivatives?

Types of Derivatives

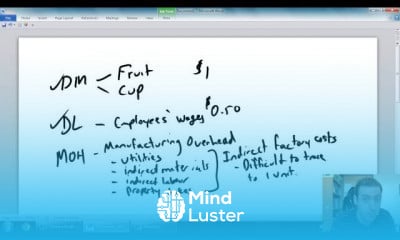

Forwards and futures. These are financial contracts that obligate the contracts' buyers to purchase an asset at a pre-agreed price on a specified future date. ...

Options. ...

Swaps. ...

Hedging risk exposure. ...

Underlying asset price determination. ...

Market efficiency. ...

Access to unavailable assets or markets. ...

High risk.What is financial derivatives with examples?

A derivative is an instrument whose value is derived from the value of one or more underlying, which can be commodities, precious metals, currency, bonds, stocks, stocks indices, etc. Four most common examples of derivative instruments are Forwards, Futures, Options and Swaps.What is financial derivatives and its types?

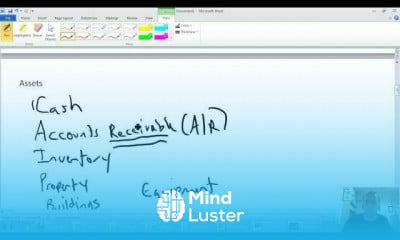

Derivatives are financial instruments whose value is derived from other underlying assets. There are mainly four types of derivative contracts such as futures, forwards, options & swaps.Features of Derivatives:

Derivatives have a maturity or expiry date post which they terminate automatically.

Derivatives are of three types i.e. futures forwards and swaps and these assets can equity, commodities, foreign exchange or financial bearing assets.Why Derivatives are dangerous?

Counterparty risk, or counterparty credit risk, arises if one of the parties involved in a derivatives trade, such as the buyer, seller or dealer, defaults on the contract. This risk is higher in over-the-counter, or OTC, markets, which are much less regulated than ordinary trading exchangesWhy is it called derivative?

I believe the term "derivative" arises from the fact that it is another, different function f′(x) which is implied by the first function f(x). Thus we have derived one from the other. The terms differential, etc. have more reference to the actual mathematics going on when we derive one from the other.

Trends

Human Resources Management

Graphic design tools for beginners

Network analysis Ankit goyal

Compiler Design Principles

ChatGPT for designers

Build a profitable trading

Figma for UX UI design

AI tools for UX UI design

Digital Image Processing

Digital Marketing Complete

E Commerce web design

Build a tic tac Toe app in Xcode

UX UI design career

MS Excel

Integrated Circuits and Applications

Python for beginners

Marketing basics for beginners

Learning English Speaking

Introduction to Human Resource Management

Advanced Logo design methods

Recent

Figma for UX UI design

UX UI design career

AI tools for UX UI design

Webflow for beginners

Graphic design tools for beginners

Customizing type for logos

E Commerce web design

Make Scrollable Prototypes in figma

Advanced Logo design methods

ChatGPT for designers

Essential skills for web designers

Framer basics for beginners

Figma components and variants

macOS app development basics

Testing in iOS fundamentals

Figma fast design techniques

Build a tic tac Toe app in Xcode

Xcode UI design for beginners

Mobile app development

Making money with apps