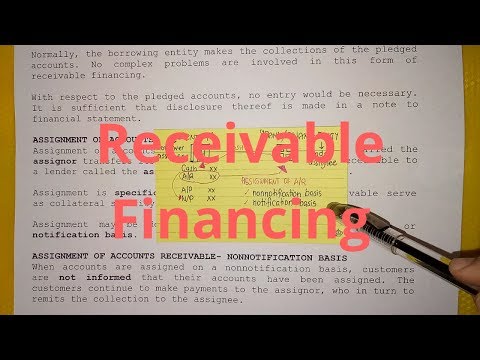

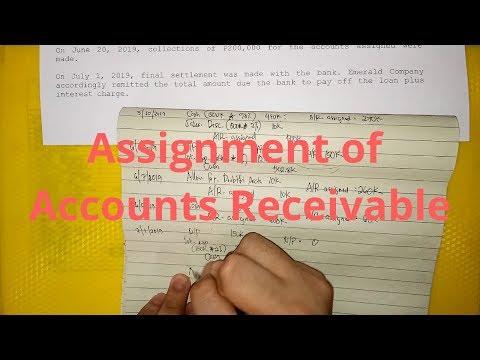

Assignment of Accounts Receivable Nonnotification basis

Share your inquiries now with community members

Click Here

Sign up Now

Lesson extensions

Lessons List | 78

Lesson

Show More

Lessons

Comments

Related Courses in Computer Softwares

Course Description

Income statement essentials course,

in this course we will learn about the Income Statement essentials, a crucial financial report that details a company's performance over a specific period. The Income Statement, also known as the Profit and Loss Statement, provides a comprehensive overview of revenues, expenses, and net profit or loss. We will start by exploring the core components: revenues, cost of goods sold (COGS), gross profit, operating expenses, operating income, non-operating expenses, income before tax, taxes, and net income. You will learn how to compile and interpret these elements to evaluate a company’s financial health. The course will cover practical applications, such as assessing profitability, identifying cost-saving opportunities, and making informed business decisions. We will also discuss common financial ratios derived from the Income Statement that are essential for analyzing trends and comparing performance across periods. Through hands-on exercises and real-world examples, you'll gain the skills needed to prepare and analyze Income Statements accurately. By the end of this course, you will be proficient in understanding and utilizing Income Statements to support strategic planning and enhance financial reporting. This course is ideal for anyone looking to deepen their knowledge of financial statements and improve their financial analysis capabilities.

Trends

MS Excel

Learning English Speaking

WiFi hacking

Adobe illustrator tools for designers

Ethical Hacking

Python programming language

Mobile Apps from Scratch

Logo Programming for beginners

Python in Hindi

Excel Course Basic to Advanced

Cybersecurity

Complete WIFI Hacking Course Beginner to Advanced

Graphic design rules for beginners

Ethical Hacking

Accounting Finance course

Embedded Systems ES

Web Design for Beginners

Building graphic design portfolio from scratch

Downloading and installing tux paint for kids

Microsoft Excel How to course

Recent

Adobe illustrator tools for designers

Graphic design rules for beginners

Isometric design in illustrator for beginners

Psychology in graphic design for beginners

Test graphic design skills for beginners

Plugins for adobe Illustrator designers

Logo design tools in illustrator for beginners

Illustrator keyboard shortcuts for beginners

Building graphic design portfolio from scratch

Audacity download and installation for beginners

Downloading and installing tux paint for kids

Building a race game in scratch for beginners

Sharing links in edmodo for beginners

Google sheets dynamic chart techniques

Building a CV website from scratch

Designing logos in google drawings for beginners

Converting PDF to google docs for beginners

Google slides text masking essentials

Inserting images in microsoft word for beginners

Hosting images on google drive for beginners