Difference Between LLC Sole Proprietorship and Corporation

Share your inquiries now with community members

Click Here

Sign up Now

Lesson extensions

Lessons List | 6

Lesson

Comments

Related Courses in Business

Course Description

Limited Liability company benefits course,

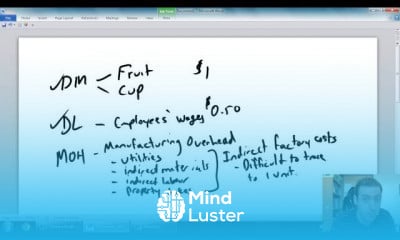

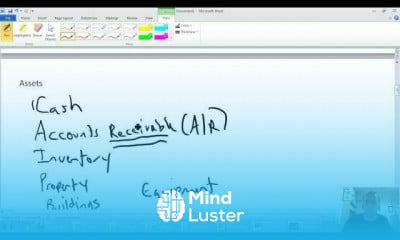

in this course will explore the numerous advantages and protections offered by the LLC business structure. From shielding personal assets to flexibility in management and taxation, this course covers the key benefits that make LLCs a popular choice for entrepreneurs and small business owners. Participants will learn how forming an LLC can provide liability protection, allowing them to separate personal and business assets and mitigate financial risks. Additionally, the course will delve into the tax advantages of LLCs, including pass-through taxation and potential deductions. Moreover, participants will gain insights into the flexibility of LLCs in terms of management structure, ownership, and operational flexibility. Whether you're considering starting a new business or restructuring an existing one, this course equips you with the knowledge and understanding needed to leverage the benefits of the LLC business structure effectively. Get ready to discover how forming an LLC can provide legal, financial, and operational advantages for your business endeavors.

Trends

Learning English Speaking

Speak english fluently with confidence

MS Excel

Building a chatbot with Python

Generative AI tools for 2024

Python programming fundamentals A Z

Content marketing for beginners

Creating YouTube videos for beginners

Python programming language

Python machine learning for beginners

Marketing basics for beginners

Cybersecurity fundamentals A Z

Makeup and Beauty

Phrasal Verbs in daily conversations

Tools and toolbar in Photoshop for beginners

Design Thinking

Introduction To Cyber Security

Excel Power Query in excel for beginners

PGP in data science and engineering

Python Programming | Edureka

Recent

Arabic numbers for beginners

Rating arabic handwriting techniques

Form verbal sentences in arabic

Arabic sentence structure for beginners

Phrasal Verbs in daily conversations

Speak english fluently with confidence

Rules for plural forms of irregular nouns

English slang dictionary for fluency

English idioms for everyday conversations

Native english vocabulary for fluency

Teach reading with Phonics for beginners

English speaking confidence techniques

Business english communication skills

American english conversation for beginners

Advanced english listening and vocabulary

English prepositions for beginners

Improve english Pronunciation for beginners

PGP in data science and engineering

Building a chatbot with Python

Python programming fundamentals A Z