Adjusting Journal Entries Prepayment type

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 19

Lesson

Comments

Related Courses in Business

Course Description

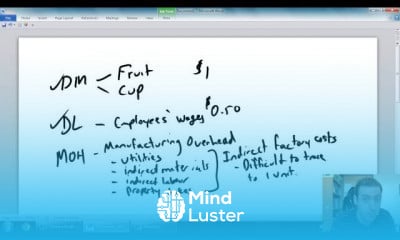

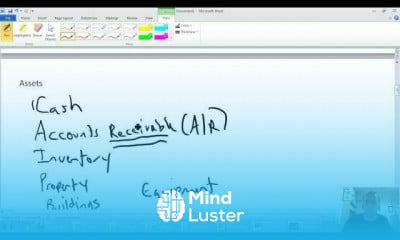

One of the main parts of accounting is recordkeeping or bookkeeping. Recordkeeping is the process of recording transactions and events in an accounting system. Since the principles of accounting rely on accurate and thorough records, record keeping is the foundation accounting.What are the types of record keeping?

Make sure you keep track of these five types of records for your business.

Accounting records. Accounting records document your business's transactions. ...

Bank statements. Bank statements are records of all your accounts with the bank. ...

Legal documents. ...

Permits and Licenses. ...

Insurance documents.How many years do you have to keep accounting records?

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return. Keep records indefinitely if you do not file a return

Trends

Electrical engineering for engineer

Human Resources Management

Graphic design tools for beginners

Artificial intelligence essentials

Essential english phrasal verbs

Learning English Speaking

Build a profitable trading

French

Biology Basics

Python programming language

MS Excel

Web Design for Beginners

YouTube channel setup

Earn money with chatGPT

Introduction to Human Resource Management

Build a tic tac Toe app in Xcode

English vocabulary verbs

Java DSA Interview Preparation

Compiler Design Principles

Excel skills for math and science

Recent

Bioinformatics basics

Bioinformatics databases

Vitamin A to Z tablets

Best zoology books

Best cream for piles pain

Laser surgery for piles

Best cream for piles

Anal fissure treatment

Best antibiotics for diseases

Antibodies structure

Macrophage structure

Drosophila genetics

Diagnostic tests

Bioinformatics

Genetics

Gene therapy

Kidney structure

DNA replication and types

Bacterial cell structure

Parasite structure