Journal Entry for Prepaid Insurance

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 15

Lesson

Comments

Related Courses in Business

Course Description

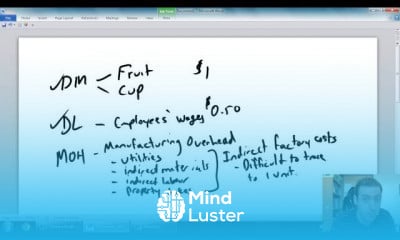

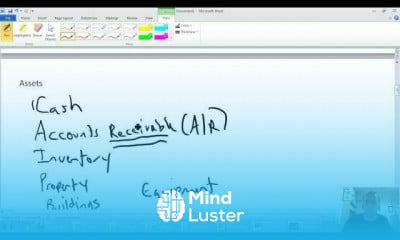

Prepaid expenses is the money set aside for goods or services before you receive delivery. Other current assets are cash and equivalents, accounts receivable, notes receivable, and inventory.Do prepaid expenses convert to cash?

Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.Are prepaid expenses Accounts payable?

Prepaid expenses refer to advance payments for business expenses, while debts owed by a company in the course of its trade are called accounts payable. Each transaction is completely different from the other, but each has a direct effect on the movement of money into or out of a business.Is prepaid rent accounts receivable?

Definition of Rent Receivable

Prepaid rent typically represents multiple rent payments, while rent expense is a single rent payment. So, a prepaid account will always be represented on the balance sheet as an asset or a liability. When the prepaid is reduced, the expense is recorded on the income statement.

Trends

UX design career in 2025

UX UI design

Web Design for Beginners

Graphic Design | Photoshop

Make money as a freelance designer

Logo Design

Accounting

Master graphic design techniques

Excel Accounting and Finance course

Accounting Finance course

Web Design Using HTML CSS

Advanced graphic design techniques

Graphic Design Basics

Web Design 101 Free Full Course

Illustrator 3D design for beginners

Financial Accounting

Illustrator for logo design beginners

Graphic design mockups

company accounts fundamentals

Figma Signing Up and Signing In

Recent

French with video and pictures

French vocabulary with videos

Everyday french with videos

French vocabulary with pictures

Weekly french words

French listening practice

French holiday vocabulary

French numbers for beginners

French listening comprehension

French self introductions

French conversational phrases

Common french words

Daily french conversations

Basic french vocabulary

Essential french vocabulary for beginners

French words to pronounce

French holiday words

French Pronunciation basics

Advanced french listening

Intermediate french listening